Media Release Feb 23, 2022

For the first time, Siegfried reports sales of more than one billion Swiss francs and increases profitability

The Siegfried Group reports sales of 1.102 billion Swiss francs for the 2021 financial year, the highest in its corporate history. This corresponds to sales growth of 30.5 percent in Swiss francs and 30.3 percent in local currencies.

Earnings before interest, tax, depreciation, and amortization (core EBITDA) adjusted for special effects grew faster than sales to 207.2 million Swiss francs, an increase of 38.8 percent. The core EBITDA margin increased to 18.8 percent (previous year: 17.7 percent).

Core net profit of 95.3 million Swiss francs, is also higher than in the previous year (72.5 million francs), an increase of 31.4 percent.

In the second half of the year, Siegfried started production («Fill & Finish») of BioNTech’s Comirnaty vaccine. In addition, Siegfried concluded a supply agreement with the US biotech company Novavax for its vaccine Nuvaxovid and established the manufacturing process.

The integration of the two Drug Products sites in Barcelona with nearly 1,000 employees, which were acquired from Novartis at the beginning of 2021 is proceeding according to plan and is making good progress.

The Board of Directors will propose to the Annual General Meeting to increase the payout to the shareholders by 20 cents to 3.20 Swiss francs per registered share (previous year: 3.00 Swiss francs). This will be effected by reducing the nominal value in the context of a capital reduction.

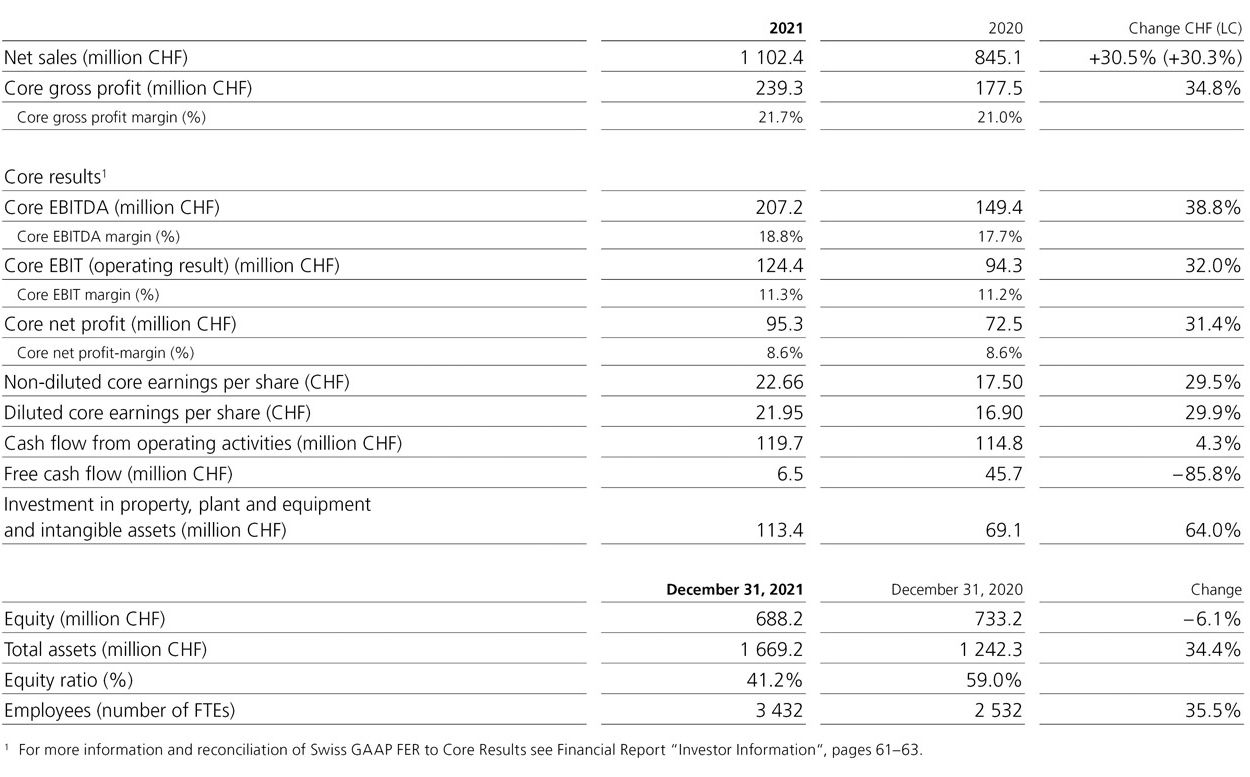

Key figures overview

SIX: SFZN. For the first time in its nearly 150-year corporate history, Siegfried reports sales of more than one billion Swiss francs. At 1.102 billion Swiss francs, sales increased by 30.5 percent (2020: 845.1 million francs). Despite challenging conditions, core EBITDA grew faster than sales, from 149.4 million Swiss francs in the previous year to 207.2 million Swiss francs, 38.8 percent higher than 2020. The core EBITDA margin improved from 17.7 percent to 18.8 percent and is thus within the preliminary target range of around 20 percent. Core net profit grew by 31.4 percent to 95.3 million Swiss francs (2020: 72.5 million Swiss francs), the highest net profit in corporate history. Net profit according to Swiss GAAP FER amounted to 95.6 million Swiss francs. The Board of Directors will propose to the Annual General Meeting an increase in the payout to the shareholders to 3.20 Swiss francs per share (2020: 3.00 francs). As in the previous year, the payout will be made by reducing the nominal value in the context of a capital reduction.

At 119.7 million Swiss francs, the Siegfried Group also delivered a very good result in cash flow from operating activity (2020: 114.8 million Swiss francs). Free cash flow amounts to 6.5 million Swiss francs, mainly due to significantly higher investments in property, plant and equipment, which increased from 77.1 million Swiss francs in 2020 to 114.0 million Swiss francs.

In the first half of the reporting period, Siegfried placed senior bonds in the amount of 200 million Swiss francs for the first time in the company’s history, financing the repayment of the hybrid bond of 160 million Swiss francs. At year-end, Siegfried had cash and cash equivalents of 72.6 million Swiss francs. Net debt amounted to 407.4 million Swiss francs, a ratio of 1.97 to core EBITDA, and the equity ratio was 41.2 percent. Consequently, even after the latest acquisition, the Siegfried Group still has sufficient capacity to finance further growth steps.

Siegfried CEO Dr. Wolfgang Wienand: “Crossing the billion Swiss franc sales mark is another important step on our ambitious growth path. We succeeded because we were not only able to seize attractive market opportunities and M&A targets, but also to take on major challenges such as the corona pandemic and the cyberattack and to overcome them as a strong team. Once again, our business model has proven to be robust and successful.”

Drug Products Division with Critical Size after Acquisition

The two pharmaceutical manufacturing sites acquired from Novartis, Barberà del Vallès and El Masnou, made a significant contribution to the substantial growth in the reporting period The two sites located near Barcelona have been part of the Siegfried Group since 1 January 2021, and very well complement the global network. They not only provide a significant increase in capacity and an expansion of the technological possibilities for the production of pharmaceutical finished products, but also a more balanced ratio between the two divisions Drug Substances (active pharmaceutical ingredients) and Drug Products (finished dosage forms). The Drug Products sales contribution increased from about 25 percent in 2020 to about 40 percent in the year under review.

The integration of the two sites is proceeding according to plan and making good progress. In the future, Siegfried will concentrate a significant part of pharmaceutical development services in Spain. The establishment of a Center of Excellence for pharmaceutical formulation development, including extensive investments, began last year and will be completed by the end of 2022.

Important Contribution to Coping with the Coronavirus Pandemic

Following intensive preparatory work, the filling line for BioN-Tech-Pfizer’s COVID-19 vaccine Comirnaty went into operation at Siegfried’s Hameln site in the second half of the year. With the rapid provision of the highly specialized line, Siegfried has demonstrated its ability to solve technologically demanding tasks even at short notice and to quickly build up the necessary capacities. In addition to BioNTech, the US biotech company Novavax also relies on Siegfried for the aseptic filling of its protein-based COVID-19 vaccine Nuvaxovid.

Sustained Development as the Core of Corporate Strategy

Siegfried achieved a success concerning sustainability in corporate management, for many years an important pillar in strategy and one of the company’s five key values. In recognition of many years of commitment and targeted implementation of appropriate business practices and initiatives in all areas and at all corporate sites, Siegfried was included for the first time in the Dow Jones Sustainability Index (DJSI) Europe. Furthermore, at the beginning of 2022, Institutional Shareholder Services Inc. (ISS), a leading global proxy consulting company, confirmed the Prime Status that it had awarded Siegfried with in 2020. In the MSCI ESG rating, Siegfried was awarded an “A” rating. In order to further advance the implementation of the various ESG initiatives, a cross-functional Corporate Sustainability Board was established in 2021 with CEO Wolfgang Wienand as sponsor, which will report regularly to the Executive Board and the Board of Directors on the status of work and progress.

Decisive Crisis Management in Special Situations

2021 was the second year of the global pandemic. COVID-19 posed major challenges for the company and its employees, particularly at the beginning and toward the end of the reporting year. Under the leadership of the crisis committee set up in 2020 and thanks to comprehensive action plans, the negative effects remained under control last year. The cyberattack was another significant challenge. It was carried out with a high degree of criminal energy affecting Siegfried at the beginning of May. Thanks to resolute crisis management and the immediate implementation of measures, the problem was quickly identified and systems were restored. Production downtime and the resulting damage was kept within limits.

Changes in the Board of Directors and the Executive Committee

In connection with the scheduled retirement of Dr. René Imwinkelried, Global Head Technical Operations and a member of the Executive Committee since 2012, at the end of 2020 and the acquisition of the two production sites in Spain, responsibility for global Technical Operations in the field of Drug Substances and Drug Products was split. At the beginning of 2021, Irene Wosgien took on responsibility for Drug Substances, and Marcel Imwinkelried at the beginning of October 2021 for Drug Products, which until then had been managed by CEO Wolfgang Wienand on an interim basis. Marcel Imwinkelried joined Siegfried Group from Novartis at the beginning of 2021.

There are also going to be changes in the Board of Directors. Reto A. Garzetti, a Board member since 2011, and Ulla Schmidt, the former German federal minister of health who was appointed to the Board in 2016, will not stand for reelection at the 2022 General Meeting of Shareholders. The Board of Directors decided to propose the election to the Board of Dr. Alexandra Brand and Dr. Beat Walti. Dr. Alexandra Brand, a German citizen and chemist, joined Syngenta in 2015 and has worked in senior positions there. Dr. Beat Walti is a partner in the Zurich-based firm of layers, Wenger & Vieli AG. He is chairman of the board of trustees of the Ernst Göhner Stiftung. He was elected to the Swiss Federal Parliament in 2014.

Increase in Sales and Profitability Expected in the Current Year and Ongoing Investments in Future Profitable Growth

Siegfried expects sales growth in the high single-digit to low double-digit percentage range for the current year. In addition, Siegfried expects the core EBITDA margin to exceed the 20 percent threshold in 2022, subject to exchange rate fluctuations and unforeseen consequences of the ongoing coronavirus pandemic. In the medium-term, Siegfried expects a further increase in sales and profitability, and therefore plans to invest in additional development and production capacity in the coming years. Overall, Siegfried expects annual CapEx spend in the low teens percentages of sales.

Cautionary Statements Regarding Forward-Looking Statements

SThis media release includes statements concerning the future. They are based on assumptions and expecta-tions that may prove to be wrong. They should be considered with due caution as, by definition, they contain known and unknown risks, insecurities and other factors which could result in a difference in the actual results, financial situation, developments or the success of Siegfried Holding AG or Siegfried Group from the explicit or implicit assumptions made in these statements.